52+ can you deduct mortgage payments on rental property

Actual expenses or the standard mileage rate. Web 1 Best answer DoninGA Level 15 June 4 2019 1135 PM Only the mortgage interest can be entered as an expenses for the rental property not the principal.

52 Residential Property In Guwahati Residential Apartments Flats Houses For Sale In Guwahati Justdial Real Estate

Web Generally deductible closing costs are those for interest certain mortgage points and deductible real estate taxes.

. Web Rental property often offers larger deductions and tax benefits than most investments. Web Still you can deduct interest on up to 750000 1 million if you took out the mortgage before Dec. For 2021 the standard mileage rate for business use was 585 cents per.

This can make a. Ad Questions Answered Every 9 Seconds. Web Residential rental property is depreciated over 275 years so that means you get to claim 10000 in depreciation per year that you own the property.

Web You can deduct travel using two methods. Web What Deductions Can I Take as an Owner of Rental Property. Should that owner have a rental.

16 2017 of secured mortgage debt on your first or second home. If you receive rental income from the rental of a dwelling unit there are certain rental expenses you may deduct on your tax return. 415 Renting Residential and Vacation Property.

Web Up to 25 cash back The 10000 loan amount is not deductible. Web If your rental property produces 50000 in rental income for the year you can take a 15000 deduction for the mortgage interest which reduces your taxable rental income. Many other settlement fees and closing costs for.

Web Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. These expenses may include mortgage interest property tax. Web Lets assume that the interest paid on the mortgage would amount to approximately 16000 in the first year of the loan.

Get Personalized Answers to Tax Questions From Certified Tax Pros 247. Instead it is added to Kens basis in the home and depreciated over 275 years. However you can deduct the mortgage interest and real estate taxes that you paid for.

Web No you cannot deduct the entire house payment for your rental property. Many of these are overlooked by landlords at tax time. The interest payments Ken makes on the.

Web The interest you pay is income to the lender however on which the lender must pay income tax -- because the lender pays the income tax on this portion you can deduct it. Get Help with Taxes Online and Save Time.

Why I M Paying Down My Mortgage Early And Why You Should Too

Can You Write Off The Difference Between The Rent Collected Mortgage Paid

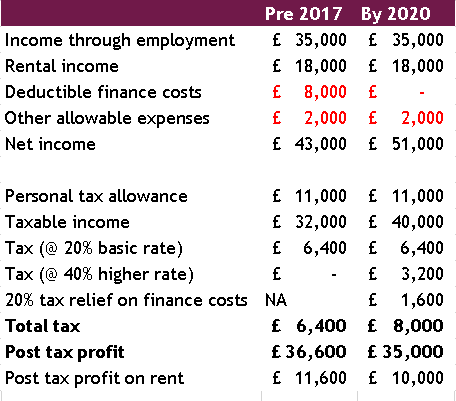

Landlord Tax Changes Come Into Effect April 2017

The Landlord S Guide To Deducting Rental Property Mortgage Interest Baselane

Gak Group Hyderabad

Home Loan Apply Home Loan Online Housing Loan Online Creditmantri

How Much Money Will I Make From My Rental Property Rich On Money

Pdf The Gender Employment Gap Costs And Policy Responses

Is Your Mortgage Considered An Expense For Rental Property

Rocky Point Times July 2022 By Rocky Point Services Issuu

Pay Off Your Mortgage Live Debt Free How One Guy Did It In 3 Years R Financialindependence

How Much Money Will I Make From My Rental Property Rich On Money

Pdf The Gender Employment Gap Costs And Policy Responses

Buy To Let Mortgage Interest Tax Relief Explained Which

Can You Deduct Mortgage Interest On A Rental Property

Can You Deduct The Difference From Rent To Mortgage Payments For A Rental Property

Gak Group Hyderabad